Why Choose KOHO Virtual Card?

What is a Virtual Mastercard handy for?

Instant approval means you can start spending, earning, and controlling your money as soon as you sign up.

How to Put Money on Our Virtual Prepaid Mastercard

Want to deposit money or load cash into your KOHO account? Whichever way you choose, it’s quick and easy.

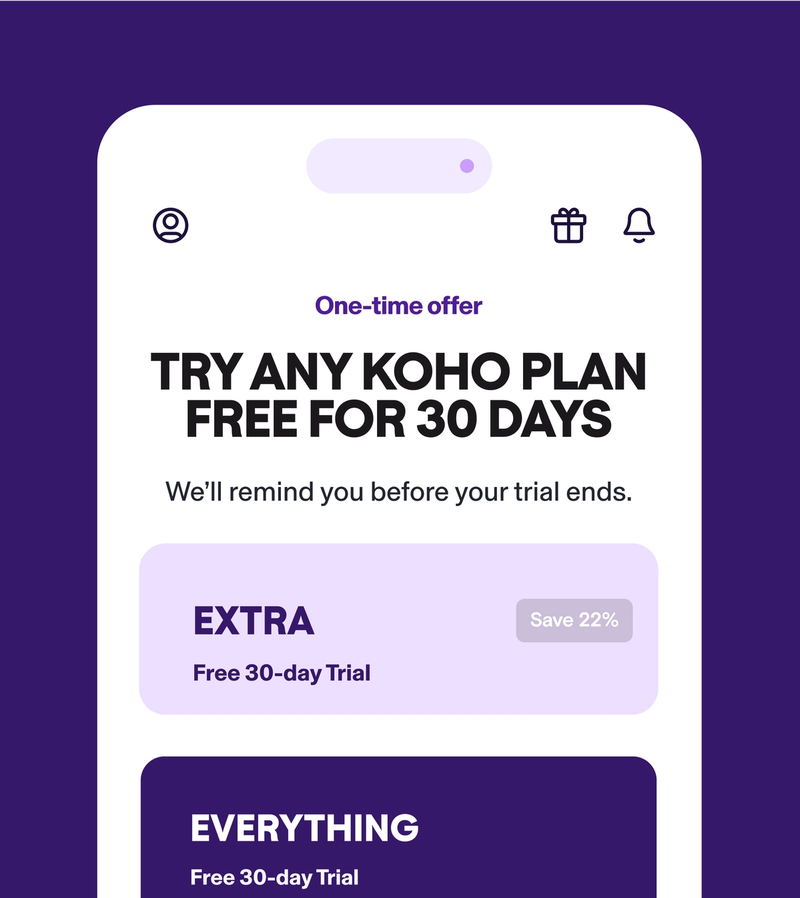

Pick a Plan and Try Our Virtual Card With No Cost

All KOHO plans come with a free 30 day trial so you can see if it suits you.

FAQS

A virtual card is an online card that lives only on your phone. You can access the details through the cards section on the app, or you can add it to the virtual wallet on your phone, like Apple, Samsung, or Google pay. You can start using it once you sign up for KOHO and add money to your account.

KOHO works with only a virtual card, but if you decide to get a physical one too, you won’t need to wait for it to arrive in the mail to start spending.

You can use your virtual card anywhere Mastercard is accepted online, or when you add it to your Google, Apple, or Samsung Pay you can tap it in person anywhere that accepts contactless payments. The only thing you can’t do with your virtual card is withdraw money from an ATM (or hold it in your hand!), you’ll need to order a physical card through the cards section on the app if you want to do this.

It’s super simple — in the cards section on the KOHO app, under your virtual card, you’ll see a button to add it to your wallet. You’ll then be redirected to Google, Apple, or Samsung Pay where you’ll follow a few short steps to get it set up and ready for spending.

You can find more information on how to set it up on each device here.

You sure can. When you sign up for a KOHO account will automatically be issued with a virtual card and be given the option to order a physical one too. Both cards will draw from the same balance but they each have their own unique card number. You’ll see both card details in the cards section of the app.

Making sure your money and information is secure is our top priority. Your account is protected by Face ID, device biometrics, password, or passcode so your card details will be kept safe from prying eyes. You can also lock and unlock your card easily in the app if you think your details have gotten into the wrong hands.

If you opt to get a physical card, this will have a separate card number to your virtual card, adding an extra layer of security. If in the unlikely event one gets compromised and you lock it in the app, you can continue using the other card in the meantime.

You can learn more about KOHO’s security here.

If you need to get a credit card quickly, applying for an instant approval credit card is your best bet. Applying for these types of cards means you’ll get an immediate decision, once you meet the issuer's requirements.

To get an instant approval credit card, you'll typically need to complete an online application. The card issuer will then review your information, and usually gives an immediate decision.

Yes, it's possible to get a credit card in one day with an instant approval credit card, but it’s worth keeping in mind, while it might take just a matter of minutes, receiving the physical card will likely take a few business days.

While it might be a little harder, it's possible to get approved for a credit card with no credit history or a low credit score. Some card issuers offer cards designed specifically for those with limited or no credit history.

The latest from our blog

News, stories and thoughts on money management

6 min read

A virtual credit card is a digital version of your physical card that you can use for online transactions. Read on to learn more!

5 min read

There really isn’t much your cell phone can’t do these days. Smartphones keep getting smarter and smarter – replacing the need to carry separate items like cameras, music players, maps, planners, games.

6 min read

Wondering if virtual credit cards are legit? Not sure how they work? We have everything you need to know right here.