Need cash or want to make a deposit without visiting a branch? Your debit card and an Automated Teller Machine (ATM), or ABM—Automated Banking Machine—as we often call them in Canada are all you need!

These handy machines let you handle your everyday banking in just a few simple steps, whenever it suits you. No more rushing to beat closing times or standing in long queues at the bank.

Whether it's the middle of the day or the middle of the night, ATMs are there when you need them. They're perfect for when you're out and about and need to quickly withdraw money or deposit a cheque.

So next time you need some quick banking, remember that ATMs give you the freedom to bank on your own schedule, anywhere, anytime!

How to Withdraw Cash from an ATM

Getting cash from an ATM is quick and easy! Here's what to do:

1. Pop your debit card into the ATM.

2. Enter your PIN (Personal Identification Number) when prompted.

3. Choose which account to take money from (like your chequing account).

4. Select how much you want to withdraw.

5. If available, pick what type of bills you'd prefer (like five $20s or two $50s).

6. If there's a fee, you'll need to agree to it.

7. Hit OK and take your card when it comes out.

8. Grab your cash and receipt (if you asked for one).

Most ATMs in Canada only give out Canadian dollars, though you'll find some that offer U.S. dollars too. If you're travelling internationally, look for currency exchange ATMs at airports.

Just a heads-up: your bank probably has a daily withdrawal limit (often around $1,000). Need more? You can usually change this limit through your online banking or by giving your bank a quick call.

How to Make a Cash Deposit at an ATM

Putting money into your account through an ATM is straightforward:

1. Insert your debit card into the machine.

2. Type in your PIN when asked.

3. Tap the "deposit" option and select which account you want to use.

4. Enter how much you're putting in.

5. Choose whether you're depositing cash, cheques, or both (if the ATM offers these options).

6. Place your money in the slot (most newer ATMs don't need envelopes).

7. If your ATM uses envelopes, put your cash or cheques inside, seal it, and then insert it.

8. Confirm everything looks right.

9. Take your card and receipt (if you want one).

Something to keep in mind: while you can take money out from pretty much any ATM, you can usually only make deposits at machines owned by your own bank. Most ATMs only accept Canadian dollars and cheques, though some take U.S. dollars too.

Need to deposit a USD cheque? You might need to visit your branch in person, though some banks now let you deposit them through their mobile app.

When you deposit cash, it's available in your account right away. Cheques are different—you'll typically get access to about $100 immediately, with the rest becoming available after the cheque clears (usually within 5-8 days).

What Fees Do ATMs Charge?

Using ATMs is convenient, but sometimes there's a cost. Here's a simple breakdown of the fees you might encounter:

Your Regular Bank ATMs

Most banks let you use their own ATMs for free, but watch out for:

Transaction limits: If your account only allows a certain number of transactions per month, you might pay $1-$2 for each extra withdrawal.

Other Banks' ATMs

When you use another bank's machine:

Network access fee: Usually $2-$3 in Canada

International ATMs: Up to $5 per withdrawal

Private ATMs

Those standalone ATMs in convenience stores or malls:

Often charge their own fee on top of any bank fees

Foreign Currency

Most banks charge about 2.5% when withdrawing money in foreign currencies

Want to save on fees? Stick to your own bank's ATMs whenever possible. If you're constantly paying extra transaction fees, it might be worth asking about an account with unlimited transactions or shopping around for a different bank.

Where to Find an ATM

Finding an ATM is pretty straightforward:

Check your bank's website or mobile app for their ATM locator

Your debit card works at virtually any ATM in Canada (though fees may apply)

When Travelling Abroad

Before heading overseas, take a quick look at your debit card:

If you see the Plus symbol, your card works with Visa's network

If you see Maestro or Cirrus, your card works with Mastercard's network

These symbols also appear on compatible ATMs worldwide. Both Visa and Mastercard offer online tools to help you locate ATMs when travelling.

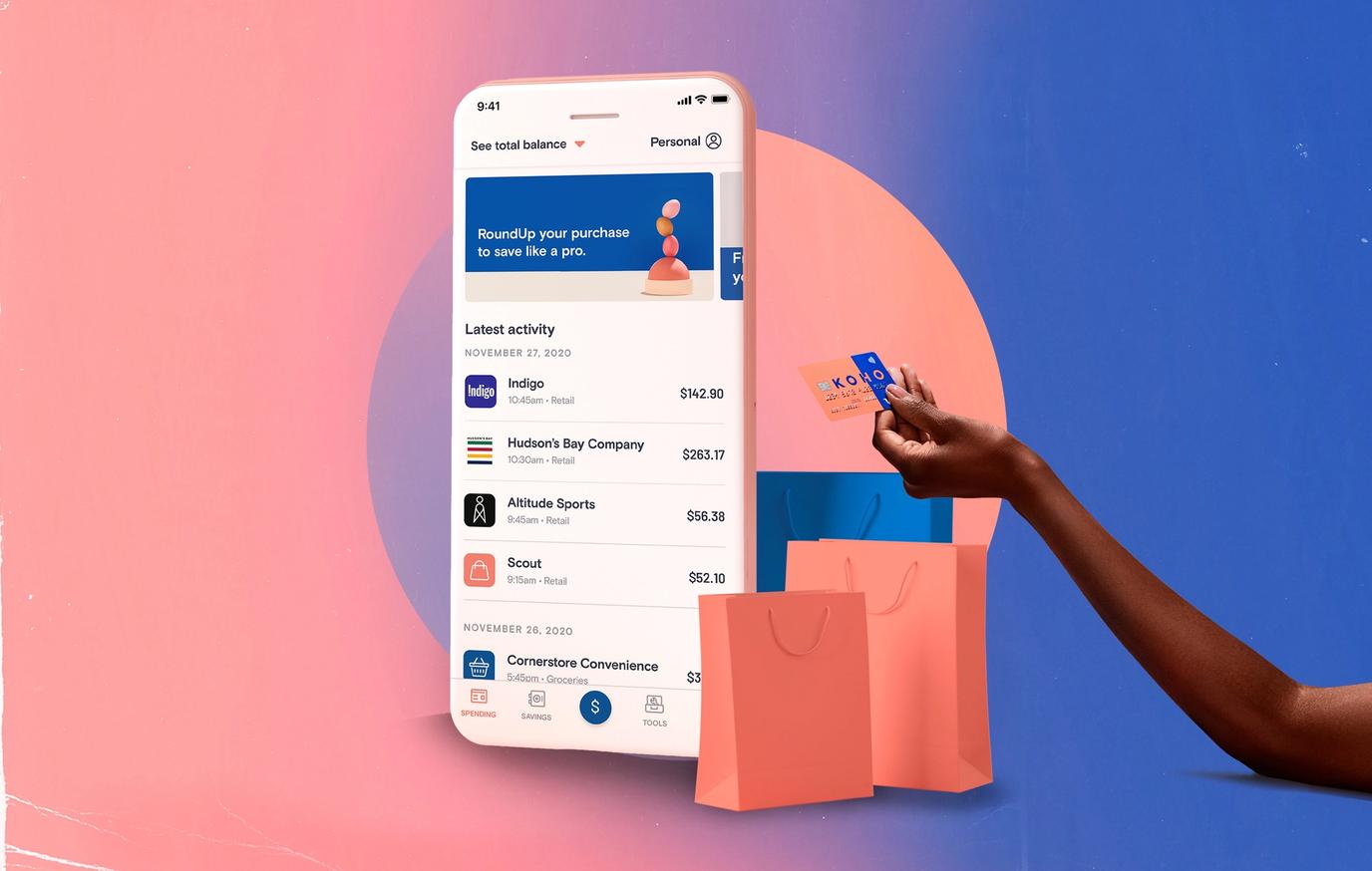

If you're planning a trip, the KOHO Extra and Everything account offers no foreign transaction fees on purchases, making it an excellent companion for international travel.

ATM Safety 101

Staying safe while using ATMs is just as important as knowing how to use them. Here are some friendly tips to keep in mind:

Before You Start

Take a quick look around. Is the area well-lit? Can people clearly see you using the machine? If something feels off, trust your gut and find another ATM.

While Using the ATM

Cup your hand over the keypad when entering your PIN

Don't worry about holding up the line – take your time to put away your cash, card and receipt properly before stepping away.

Trust Your Instincts

Notice someone hanging around that makes you uncomfortable? Cancel your transaction and leave.

If you think someone is following you after you've used an ATM, head to a busy place like a shop or restaurant and call for help if needed.

Extra Tips

Using one of those bank vestibule ATMs that need your card to enter? Don't hold the door open for strangers – they can use their own card if they're legitimate customers.

At drive-up ATMs, keep your car doors locked and windows up except for the driver's window.

Planning to hop out of your car to use an ATM? Turn off the engine and lock up – even if you'll only be a minute.

Planning Ahead

Some ATMs, especially those in malls or shops, aren't available 24/7. If you know you'll need cash, try to withdraw it during regular business hours.

Protecting Your Card

Your debit card is like a key to your money, so it's worth taking a few simple steps to keep it safe.

Keep It Safe

Treat your card like you would cash – keep it somewhere secure where it won't get bent, scratched or stolen. A wallet or cardholder works perfectly!

PIN Smarts

Try to memorize your PIN rather than writing it down. If you absolutely need to keep a record, don't store it in your wallet or on the card itself (that's like leaving your house key in your front door!).

Choosing a Good PIN

When picking a PIN, avoid the obvious stuff:

Skip your birthday, initials, or address

Don't use your phone number or SIN

Avoid simple patterns like 1234 or 0000

Using a number that means something to you but wouldn't be obvious to others is your best bet. And if your current PIN is too easy to guess, just pop into your bank or call them to get a new one.

If Your Card Goes Missing

Notice your card is gone? Don't wait – call your bank right away. Most Canadian banks have 24-hour hotlines for reporting lost cards, and quick reporting can prevent someone else from using your money.

Track Your Spending

Hang onto those ATM receipts until you check them against your monthly statement. It's an easy way to spot any unusual transactions that might signal fraud.

About the author

Nick is a freelance writer and entrepreneur with a particular interest in business finance. He's been featured in publications like Popular Mechanics and Apple News

Read more about this author