If you’re on a home-buying journey or making a large deposit on a big purchase, you might find yourself in need of a bank draft. As a guaranteed form of payment, bank drafts can be helpful when you need funds to clear quickly, but they aren’t always free and can take a few days to clear.

Here’s everything you need to know about bank drafts, what they’re for, and how to get one.

What is a bank draft?

A bank draft is a guaranteed form of payment offered by financial institutions. Like cashiers' cheques in the United States, a bank draft is Canada’s form of guaranteed payment. You would use a bank draft instead of cash, a debit card, or a cheque for a large deposit or whenever a certified form of payment is required.

It’s similar to a cheque, but since it’s certified, you can think of it as a bank cheque.

How do bank drafts work?

You can get a bank draft at your financial institution, whether it's online or offers physical branch access. Online banks typically let you request a bank draft from your online account or by phone.

Once you request a bank draft, the money will typically leave the payer’s account immediately.

Can you use a cheque instead of a bank draft?

It depends. If your financial purchase will allow a personal cheque, then yes. A bank draft will be needed if it requires a guaranteed form of payment. You might also request a bank draft instead of a cheque if you need the payment made in a currency other than Canadian dollars.

How much do financial institutions charge for bank drafts?

Some banks and credit unions offer free bank drafts. For example, if you pay a monthly fee for your bank account, that fee might include the cost of a bank draft. Otherwise, the cost can vary by bank. Expect to pay up to $9.95 for each bank draft you request.

What is a bank draft used for?

You might use a bank draft for several reasons, but the most common is for a down payment on a home. When making a down payment or paying for other costs associated with home buying, your lawyer will require a guaranteed form of payment.

Sometimes, you may need a bank draft to purchase a vehicle or for its down payment. Occasionally, your landlord may also request for a security deposit in the form of a bank draft to guarantee the money.

Do bank drafts clear right away?

While the funds for a bank draft will typically leave your bank account immediately, the funds don’t generally clear right away. Instead, it can take up to a few days for the bank draft to clear. Keep this in mind if you’re facing a tight payment schedule and need the funds to clear by a particular date.

How to get a bank draft from your financial institution

When you’re ready to obtain a bank draft, you can do so by getting one online, calling your bank or credit union, or visiting your branch in person.

The bank representative will fulfill your order by withdrawing the agreed-upon amount from your bank account and then issuing your bank draft. It will look similar to a cheque. Once the draft is in your hands, it becomes your responsibility to get to the recipient.

Can I get a bank draft without a bank account?

You’ll need a bank account to obtain a bank draft. The good news is, it’s relatively easy to open a bank account at a traditional or online bank in Canada. You can open a new account in minutes — just make sure you take some time to find the right bank for you.

Some bank accounts come with monthly fees, while others are free. Some allow you to transfer money between bank accounts for free, while others might charge for this service. Some charge overdraft fees or while others might charge non-sufficient funds (NSF) fees.

Look for a bank that fits your budget and needs. If you need to cash cheques online frequently, look for banks with robust digital tools. If you prefer in person service, look for a bank with branches near you. There’s no one-size-fits-all bank, but you’ll want to find the best financial institution for your money goals.

What happens if I lose my bank draft?

If you misplace your bank draft before you deliver it to the recipient, you may be able to replace it. You may need to sign an indemnity agreement and provide a surety bond to get a replacement.

Can you cancel bank drafts?

If you decide you no longer want to fund a deposit or make a big purchase, you can return the bank draft to your financial institution to have the money added back into your bank account. But if you’ve already handed the bank draft to the intended recipient, it’s often impossible to cancel at that point in time.

Alternatives to bank drafts

If you’re looking for a certified way to send money to someone, you may be able to use other means than a bank draft.

For instance, if a recipient is nervous about a personal cheque cashing, you might consider withdrawing cash and paying them directly or sending payment through money transfer apps.

If the person is looking for a more certified form of payment, a money order may also suffice. It’s not identical to a bank draft but is guaranteed, unlike a personal cheque.

Are a bank draft and a money order the same?

Bank drafts and money orders have many similarities but are different forms of payment. While both are certified, can be obtained at financial institutions, and can cost up to $9.95, the similarities end there.

A money order is typically a form of payment you might purchase if you do not have a bank account and need to send a cheque. While you can buy a money order at a bank, you can also purchase one at Canada Post. You do not need a bank account to get one at Canada Post. Money orders also have limits, with the options at Canada Post typically going up to $999.99.

A bank draft almost always requires a bank account to obtain, and you need to get one from a financial institution. The maximum amount is generally much higher, though each bank has its own guidelines and limits.

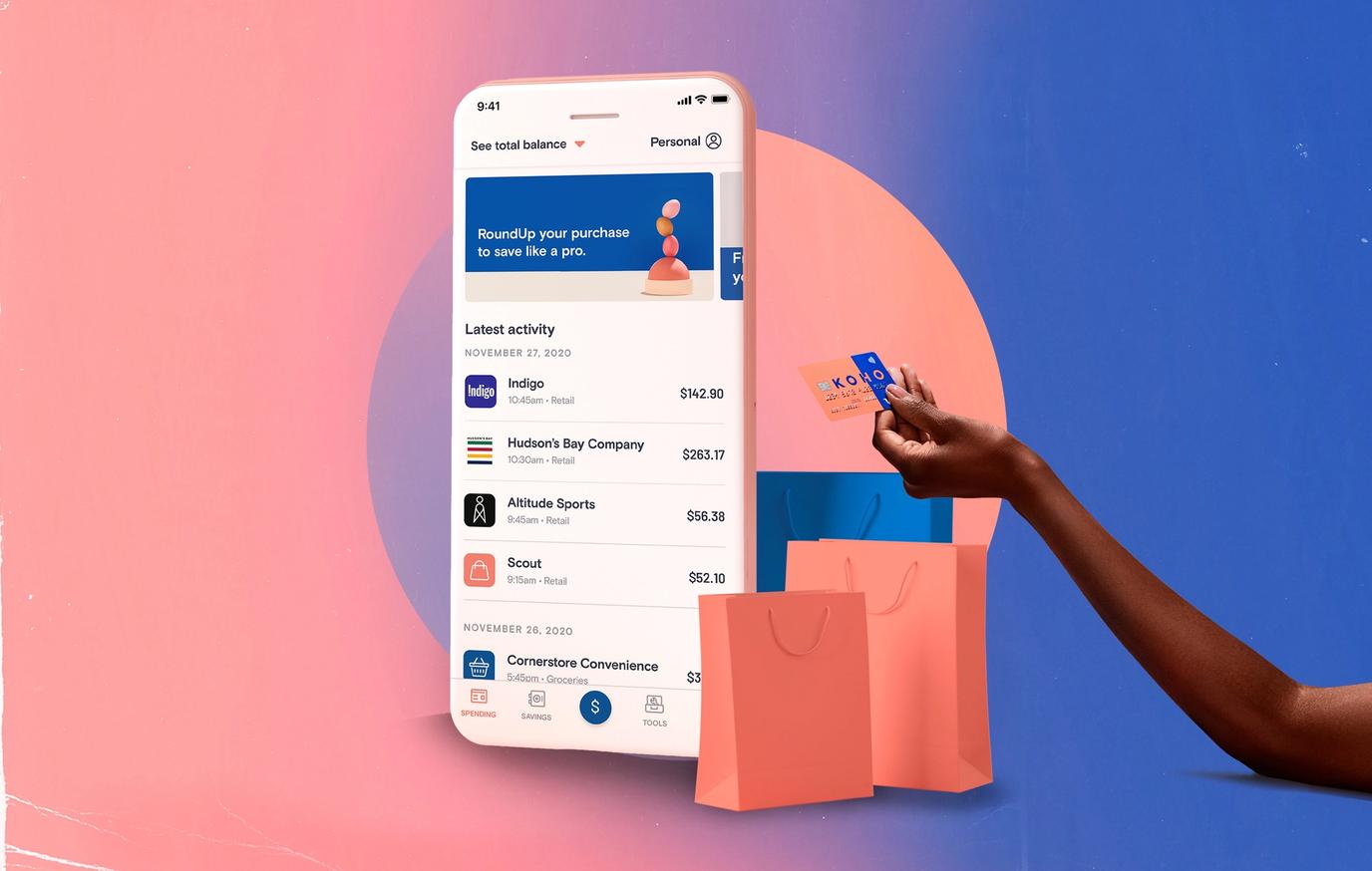

Saving for a down payment? KOHO can help

You may be working ahead to figure out how to get a bank draft for a future home purchase. If you’re building up savings for a down payment on a house, KOHO’s high interest savings account can put your money to work for you.

Not only does KOHO’s savings account offer instant cash advance, virtual card access, and no NSF fees, but it’s also easy to use. And since you need to build your credit score to get a good interest rate on a home loan, the free credit score access KOHO provides may come in handy.

About the author

Courtney is a professional writer, editor and financial literacy enthusiast. You can find her writing on CNET, Investopedia, The Motley Fool, Yahoo Finance, MSN and The Balance. She spends her free time exploring different cities across the globe or enjoy some downtime with her two cats and one dog.

Read more about this author