Credit scores help decide if you can get loans, credit cards, and mortgages. In Canada, Equifax and TransUnion calculate your 3-digit score using their own systems, but they also use scoring models from companies like FICO.

While FICO isn't a credit reporting agency in Canada, it does provide the scoring models that Equifax and TransUnion use.

What is a FICO Score?

A FICO Score (sometimes called a beacon score) is a number between 300 and 900 based on five main things:

Your payment history

Account history

Public records (or credit mix)

Credit inquiries

FICO stands for Fair Isaac Corporation, the American company that created this system back in 1989.

FICO Score categories

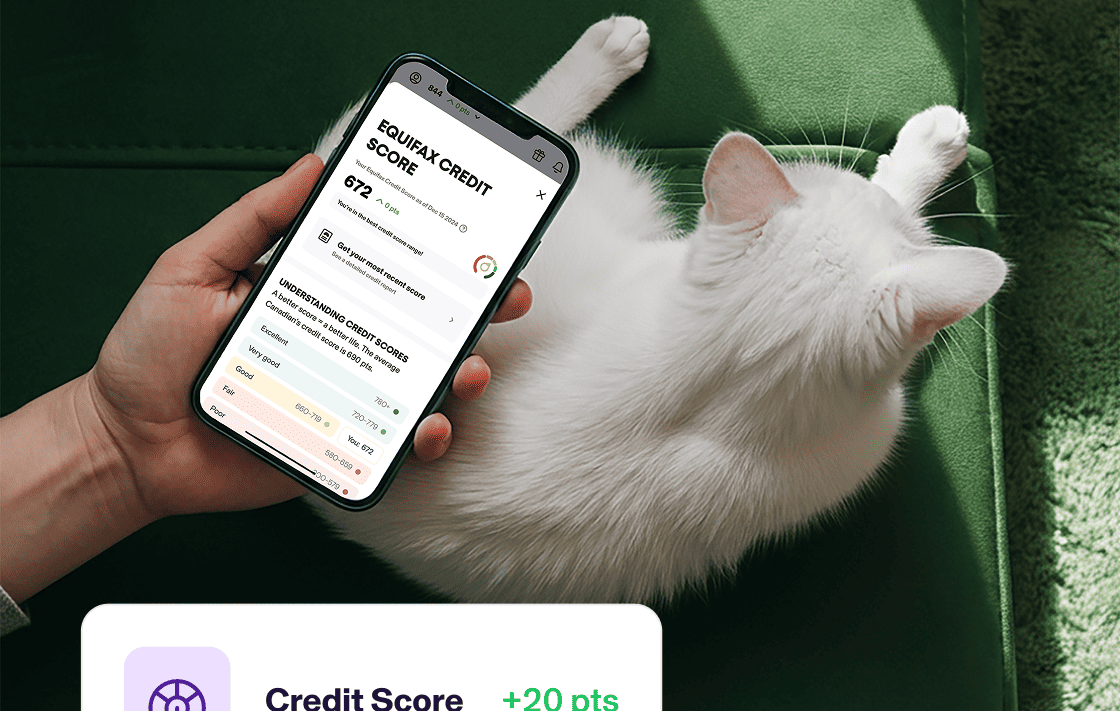

Here's what different FICO scores mean:

Poor (579 and below): You'll likely be seen as a credit risk and have trouble getting loans or credit cards.

Fair (580 to 669): Some lenders might not think you're creditworthy. You might need lenders who work with bad credit, and you'll pay higher interest rates.

Good (670 to 739): You can qualify for many loans and credit cards.

Very Good (740 to 799): You'll be seen as low risk, getting better terms, lower interest rates, and higher credit limits.

Exceptional (800 and above): You'll get approved for most financial products with the best terms and rates.

FICO scoring models in Canada

FICO has created different scoring models over the years:

FICO 5 is used mainly for mortgages and car loans

FICO 8 (from 2009) is used by credit card companies

FICO 10 (from 2022) is the newest model and is used in Canada by TransUnion and Equifax

How to access your FICO score in Canada

The FICO Score Open Access program lets some Canadian lenders show you your FICO score for free. Ask your bank or lender if they offer this.

Otherwise:

All Canadians can get their Equifax score for free online or by mail

Quebec residents can get free TransUnion scores

Some banks show credit scores in their online banking

Other credit score providers

FICO doesn't manage credit scores directly in Canada but provides models to the bureaus.

Different companies can show you your credit score and report:

ClearScore uses TransUnion data

These services help you track your credit and might suggest financial products that fit your situation.

Improving your FICO score

Your credit utilization (how much available credit you're using) makes up 30% of your score. Try to keep it under 30%.

These habits will help your score:

Pay bills on time (this is 35% of your score)

Keep credit card balances low

Check your credit reports for mistakes

Don't apply for too many credit products at once

» Learn more about how to improve your credit score.

How KOHO can help build your credit history

How it works

Start building credit history with ease by opening a KOHO line of credit separate from your balance. We'll set aside an amount from your line of credit each month, reporting it as an on-time payment to Equifax. It's simple, safe, and secure.

Unlike traditional credit cards, KOHO doesn't require a credit check to get started, making it accessible even if you have a poor or limited credit history. Since you're using your own money rather than borrowed funds, there's no risk of going into debt or missing payments—a common issue that damages many people's credit scores.

Build Your Credit History.

What this means for you

Credit scores impact your everyday financial life. The better your FICO score, the less you'll pay for loans and the more options you'll have.

Building good credit isn't complicated, but it does take time. Focus on the basics—pay on time, keep balances low, and be careful about applying for new credit.

Check your score regularly through your bank, credit bureaus, or services like KOHO. This helps you catch problems early and see your progress.

Even small improvements to your score can save you thousands in interest over time. Whether you're just starting out or rebuilding after setbacks, the habits you create today will shape your financial options tomorrow.

About the author

Quan works as a Junior SEO Specialist, helping websites grow through organic search. He loves the world of finance and investing. When he’s not working, he stays active at the gym, trains Muay Thai, plays soccer, and goes swimming.

Read more about this author