Many people find budgets scary. Who wants to track every penny in a spreadsheet or give up small pleasures? ("Not my Amazon Prime!")

But financial responsibility means knowing where your money goes. If you want to retire someday, you need to understand your spending habits.

Does this mean giving up morning coffee or scented candles? Not necessarily. You can have fun money—just with limits.

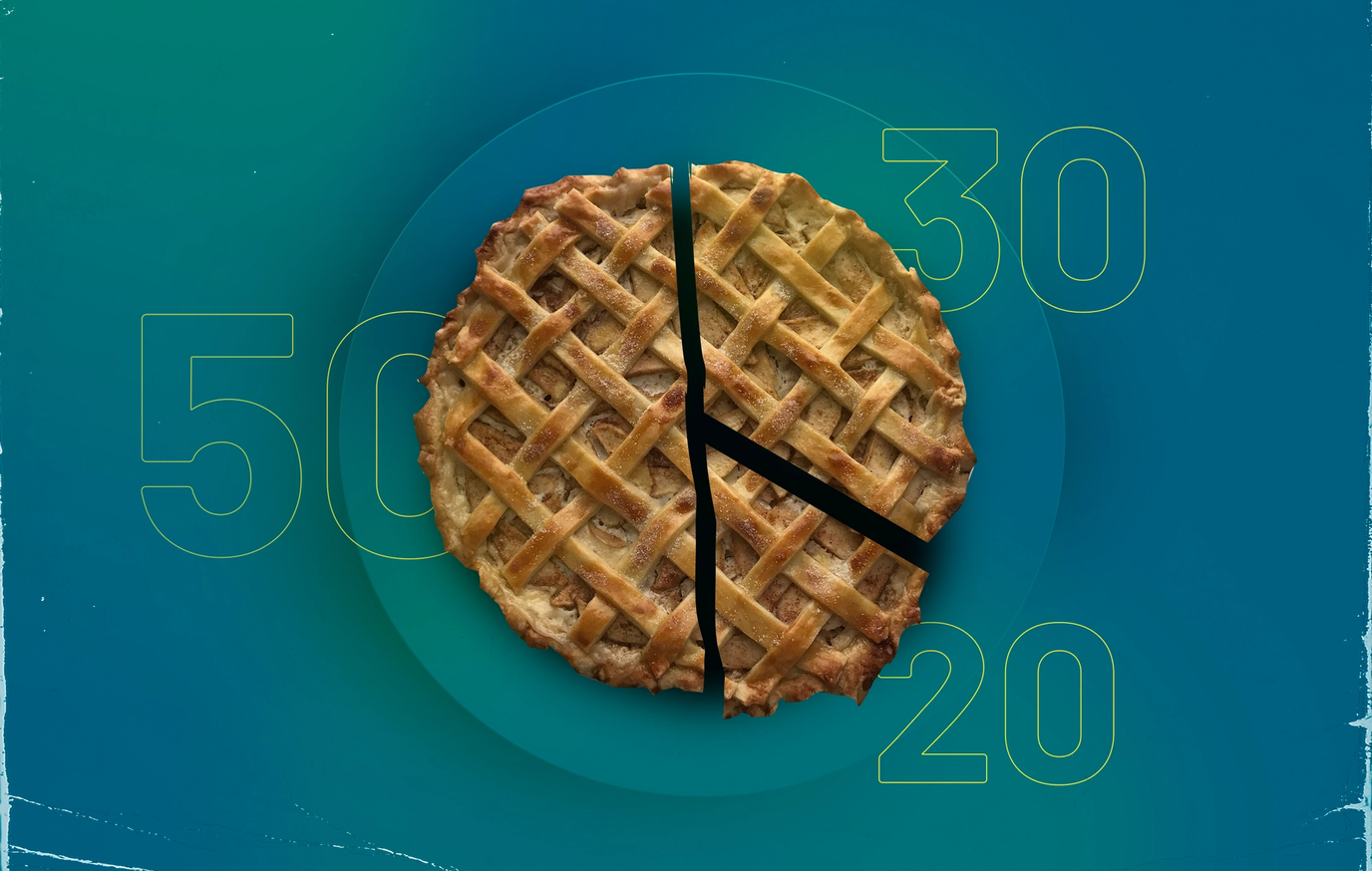

Most of us know we should budget but don't. Why? It's hard to predict monthly expenses, and looking at bank statements can be uncomfortable. That's why the 50-20-30 rule became popular. But does this budgeting method actually work? Let's break it down:

What is the 50-20-30 Rule?

The 50-20-30 rule splits your money into three buckets:

50% for essentials: Rent, utilities, groceries, gas

20% for savings: Emergency funds, retirement, debt payments

30% for everything else: Dining out, clothes, streaming services, gym memberships

But this rule isn't perfect for everyone. If you live in Toronto or Vancouver, housing might eat up most of your paycheck. Freelancers with irregular income might struggle with fixed percentages. And what about those with heavy student loans or entry-level jobs?

If the 50-20-30 split doesn't work for you, don't worry. There are other budgeting methods that might fit your situation better.

Benefits of the 50-30-20 Rule

The 50-30-20 rule can help your finances in several ways:

Simple to use: This budget is easy to understand and follow. Just split your money into three parts—no complicated math needed. Even if you're new to budgeting, you can handle this system.

Better money habits: Having a plan helps you balance necessities, fun spending and future savings. You cover today's needs while still planning for tomorrow. And with KOHO Credit Builder, you can improve your credit history while sticking to your budget.

Essentials come first: By setting aside half your income for necessities, you're less likely to miss rent or utility payments. Your basic needs get priority.

Savings become automatic: When 20% of your income goes straight to savings, debt payoff or investments, you build good financial habits. This creates a safety net for unexpected costs and helps you reach long-term goals.

Financial security: Regular saving builds wealth over time. That 20% adds up, creating stability for you and your family down the road.

Meet Jae: A real-life look at the 50-30-20 budget

Jae just landed their first full-time job after college. They want to start off on the right foot with money and heard about the 50-30-20 rule. Here's how they made it work.

Getting started

First, Jae downloaded a budget app to track spending for a month. The app sorted their purchases into needs, wants, and savings categories.

Jae's monthly take-home pay is $3,500. That's what they'll use to build their budget.

Breaking it down

After looking at their spending, Jae found their essential costs:

Rent

Utilities

Groceries

Bus pass

Student loan payments

These added up to about $1,750 per month—exactly 50% of their income. Perfect!

Jae then set aside $1,050 (30%) for fun stuff and $700 (20%) for savings and retirement. They set up automatic transfers to their savings account on payday so they wouldn't forget or be tempted to spend it.

Rolling with changes

Six months later, Jae got a promotion. Since their income changed, they adjusted all three budget categories.

They also noticed their transportation costs were higher than expected, so they started carpooling with a coworker to save money.

Sticking with it

Jae keeps an eye on their spending and adjusts when needed. As they earn more, they update their budget but keep the same percentages.

By sticking to this plan, Jae covers their bills, enjoys life today, and saves for tomorrow. Simple as that.

SPEND SMARTER. SAVE FASTER

The envelope system

Seeing your money can make you spend it more wisely. That's the idea behind the envelope system. Label three to five envelopes for different spending categories like "Groceries & Dining" or "Monthly Bills." The cash in each envelope is all you can spend in that category for the month.

Round up purchases to the nearest dollar to avoid pockets full of change. Put that spare change into savings instead.

But this simple method has drawbacks. Carrying cash isn't always safe, and it's tempting to borrow from one envelope when another runs empty.

The 80-20 plan

If detailed categories seem too much, try the 80-20 plan. It's dead simple: save 20% of your income, spend the rest however you want.

The key is automation. Set up automatic transfers to move 20% straight to a KOHO High Interest Savings Account when you get paid. Even better, ask your employer to split your direct deposit—20% to savings, 80% to checking. When the money never hits your main account, you won't miss it.

SPEND SMARTER. SAVE FASTER

Create your own plan

Everyone's money situation is different. Making your own budget often works best.

Start by listing all your monthly expenses. Check bank statements to catch those sneaky subscription charges you might forget.

Next, figure out your after-tax income. That's straightforward with a regular paycheck but trickier if you freelance or have multiple income sources.

Quick budgeting checklist:

Add up all expenses

Calculate take-home pay

Set savings and debt payoff targets

Track where your money goes

Once you know these numbers, you can plan where every dollar should go and see what's left for fun money.

Keep all receipts and review them monthly with your bank statements. This shows where you're overspending or where you might find extra savings.

About the author

Quan works as a Junior SEO Specialist, helping websites grow through organic search. He loves the world of finance and investing. When he’s not working, he stays active at the gym, trains Muay Thai, plays soccer, and goes swimming.

Read more about this author