One account,

all the perks

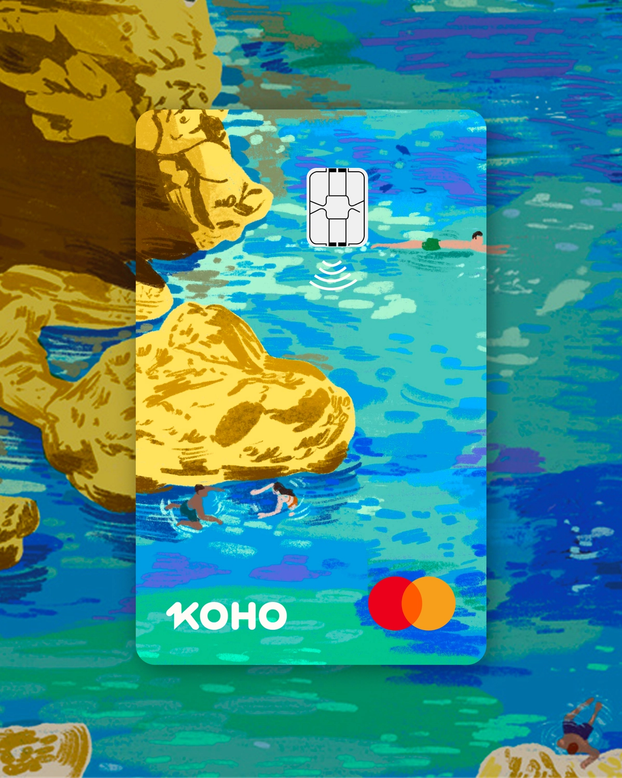

When you go abroad, KOHO is your everyday Mastercard with all the travel perks.

- No additional foreign transaction (FX) fees.*

- Access your cash anywhere, with one free international ATM withdrawal each month.

- Easily lock your card in-app if it’s lost or stolen.

- Rest easy in case of unauthorized use with Mastercard zero liability policy.

- Get up to 2% cash back on groceries, dining and transportation—even when abroad.

- Earn extra cash back from travel-related partners like Expedia, Booking.com, Contiki and more.

instant travel data with eSIM

Wherever you go, you can use your phone just like at home. Get your free KOHO eSIM, provided by Airalo, included in your plan.

Up to 3GB data free

Connect in 200+ countries

Top up anytime

Our Extra and Everything plan members get a KOHO eSIM included in your plan. Plus up to 3GB of monthly data!

- Activate your eSIM

First, you’ll need to be on an Extra or Everything plan. Then activate your free eSIM and choose from 200+ international destinations. - Seamless connection

USA, Europe, Mexico, Japan, France, Portugal, Italy, UK, India and more. When you get to your destination, your eSIM will automatically connect to the local network. Giving you data right away. - Use your phone like home

Enjoy data for messaging, maps and browsing — no SIM swapping or wifi-hunting needed!

Relax knowing your trip is covered

Bag lost in transit? Baggage coverage

Airline strike? Interruption coverage

Unexpected injury? Emergency medical coverage

The average Canadian spends up to $640 per year on travel disruptions. Before you go on your adventure, get Travel Insurance so you’re covered against the unexpected.**

- Sign up for the Essential, Extra, or Everything plan to enrol in Travel Insurance.

- Select your travel dates to ensure you’re covered throughout your trip.

- Review the available coverage options and select the protection that best suits your travel plans.

- Emergency medical services: Coverage for unexpected medical emergencies abroad, including hospital visits, treatments, and emergency transport.

- Trip cancellation & interruption: Protection if your trip is unexpectedly canceled or interrupted for a covered reason, helping you manage unforeseen changes.

- Accidental death & dismemberment: Financial protection for you or your loved ones in the event of severe injury or loss of life while traveling

- Lost or damaged baggage: Coverage for lost, stolen, or damaged baggage and personal items while you’re traveling.

- Rental car protection: Coverage for damage, theft, or liability when renting a vehicle, so you can drive worry-free.

Coverage available from $20*

Add it all or choose a few—whatever suits your needs.

Pick a plan and try it with no cost

Join others travelling smarter with KOHO.

Making

real progress

Discover what our members love about KOHO.

FAQS

An eSIM (embedded SIM) is a digital cellular plan from a carrier without the need for a physical SIM card.

With eSIMs, you can switch data carriers without needing to obtain and insert a new SIM card! This is particularly useful for travellers who need to access the internet outside of Canada.

Please note, eSIMs do not support voice call and SMS texting for the time being.

Your device must be carrier-unlocked and eSIM-compatible. You can check out this article to see if your device is supported.

We’ll also let you know before you purchase an eSIM in-app if your device isn’t compatible.

Travel insurance covers a whole host of things when you travel, either domestically or internationally. It helps offset the cost of trip interruption, illness, loss of baggage, and even repatriation.

Travel insurance has a few different coverages, depending on the type and level of policy you select, including:

- Emergency medical services: Coverage for unexpected medical emergencies abroad, including hospital visits, treatments, and emergency transport.

- Trip cancellation & interruption: Protection if your trip is unexpectedly canceled or interrupted for a covered reason, helping you manage unforeseen changes.

- Accidental death & dismemberment: Financial protection for you or your loved ones in the event of severe injury or loss of life while traveling

- Lost or damaged baggage: Coverage for lost, stolen, or damaged baggage and personal items while you’re traveling.

- Rental car protection: Coverage for damage, theft, or liability when renting a vehicle, so you can drive worry-free.

The cost of travel insurance will vary for each trip, depending on your personal details as well as things like trip duration and cost. To give you an idea, the price of a 5 day trip can start as low as $20*

*This price is an estimate for an Emergency Medical Premium, based on a 30 year-old male travelling from Ontario to Mexico for 5 days at a trip cost of $1,000. The price varies based on personal, trip and other details unique to each person.

When you sign up for a paid plan (Essential, Extra, or Everything), you can enrol for Travel Insurance. Just open the KOHO app, head to the Discover tab, and choose Travel Insurance

The easiest way to get information about your Travel Insurance is by referring to the policy documents for your coverage that you receive by email after purchase. If you still have questions regarding your policy, contact our insurance partner, Walnut, at 1-855-558-1605 or via email at [email protected].

*No 1.5% FX fee if you are on Extra or Everything plan, currency conversion rate applies.

**Insurance provided by a third party insurance provider and Walnut is the broker on record. Terms and Conditions apply.